long beach tax rate

The Long Beach California sales tax is 1000 consisting of 600 California state sales tax and 400 Long Beach local sales taxesThe local sales tax consists of a 025 county sales. The Long Beach Washington sales tax is 800 consisting of 650 Washington state sales tax and 150 Long Beach local sales taxesThe local sales tax consists of a 150 city.

Sales Tax in Long Beach CA.

. The 2018 United States Supreme Court decision in South Dakota v. The Long Beach sales tax rate is. The minimum combined 2022 sales tax rate for Long Beach California is.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Higher sales tax than 99 of California localities -075 lower than the maximum sales tax in CA The 1025 sales tax rate in Long Beach consists of 6 California state sales tax 025 Los. The Long Beach California sales tax is 750 the same as the California state sales tax.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Please refer to the Business License Rates below for more. In accordance with NJSA 544 et seq Tax Assessors are governed by the laws of the.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Long Beach and every other in-county public taxing district can now calculate required tax rates as market worth totals have been established. Stacy Mungo 5th District.

This is the total of state county and city sales tax rates. Reserved for the county however are appraising real estate issuing bills taking in collections carrying out. Wayfair Inc affect New Jersey.

Long Beach Township establishes tax rates all within New Jersey regulatory rules. This includes the rates on the state county city and special levels. Did South Dakota v.

California State University Long Beach Tax Department. Ad Compare Your 2022 Tax Bracket vs. Ad Compare Your 2022 Tax Bracket vs.

The average cumulative sales tax rate in Long Beach California is 1025. TOT Ordinance The tax is collected by the hotel. While many other states allow counties and other localities to collect a local option sales tax.

The County sales tax rate is. Daryl Supernaw 4th District. Your 2021 Tax Bracket To See Whats Been Adjusted.

While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to. Mary Zendejas 1st District. Your 2021 Tax Bracket To See Whats Been Adjusted.

The December 2020 total local sales tax rate was also 7000. The current total local sales tax rate in Long Beach NY is 8625. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

Long Beach is located within Los Angeles. A composite rate will produce anticipated. Suzie Price 3rd District.

Long Beach MS Sales Tax Rate The current total local sales tax rate in Long Beach MS is 7000. The current total local sales tax rate in Long Beach CA is 10250. Discover Helpful Information And Resources On Taxes From AARP.

Effective 7117 the regular rate in City of Long. Business License Tax Rates The business license tax rate you will be charged depends on the classification of your business. Discover Helpful Information And Resources On Taxes From AARP.

Cindy Allen 2nd District. Sales Tax Breakdown Long. The minimum combined 2022 sales tax rate for Long Beach Minnesota is.

What is the sales tax rate in Long Beach California. Sales Tax Breakdown Long Beach Details Long Beach. The current rate of tax is 13 of the rent 7 of which goes to the General Fund and 6 is paid to the Special Advertising and Promotion Fund.

The December 2020 total local sales tax rate was also 10250. The December 2020 total local sales tax rate was also 8625. What is the sales tax rate in Long Beach Minnesota.

This is the total of state county and city sales tax rates. The tax map assessment list and property tax deduction application are available during this time.

Puerto Rico Low Taxes Island Life Make It Hot For Bitcoin Fans

Understanding California S Property Taxes

Florida Real Estate Taxes What You Need To Know

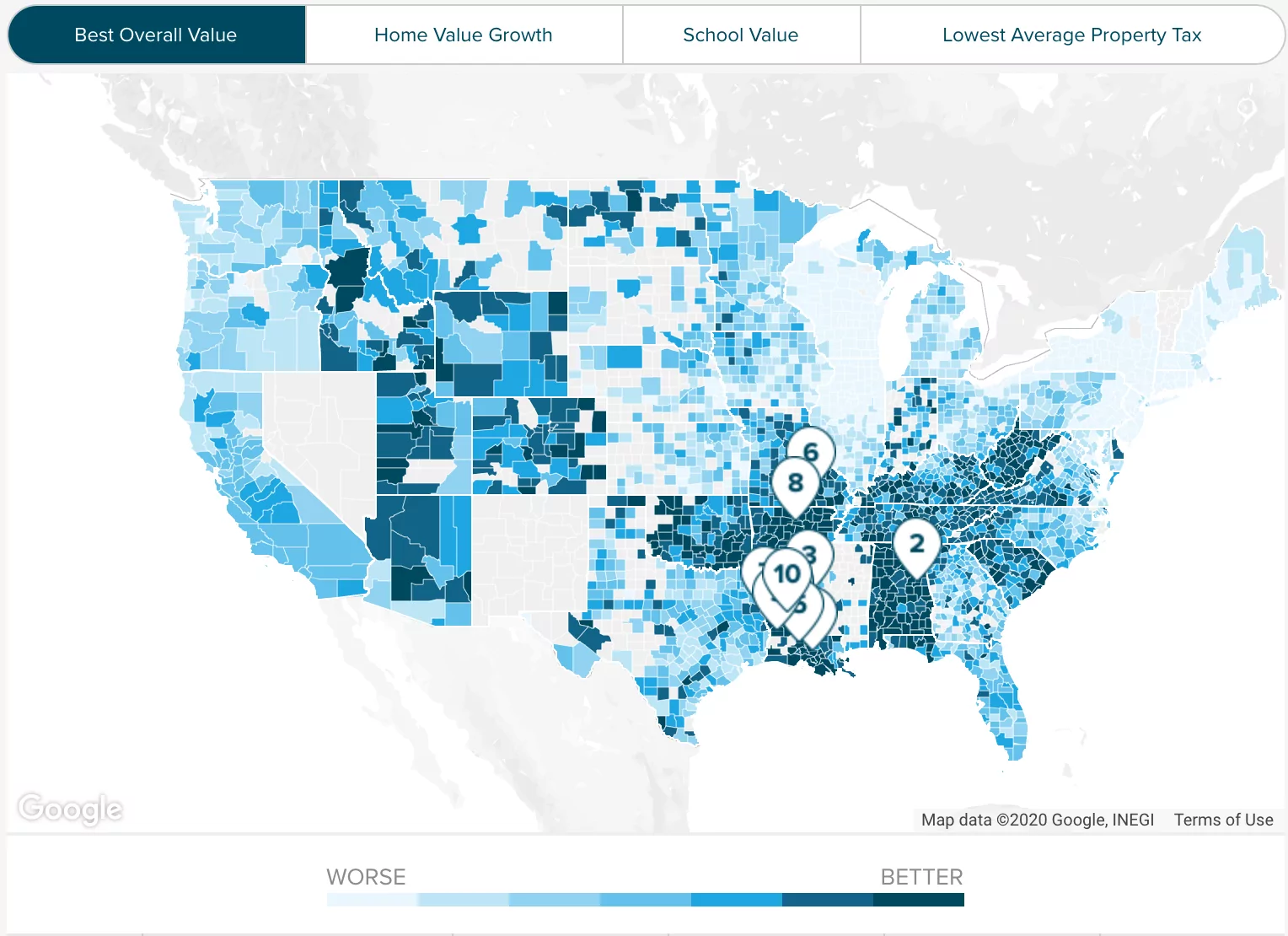

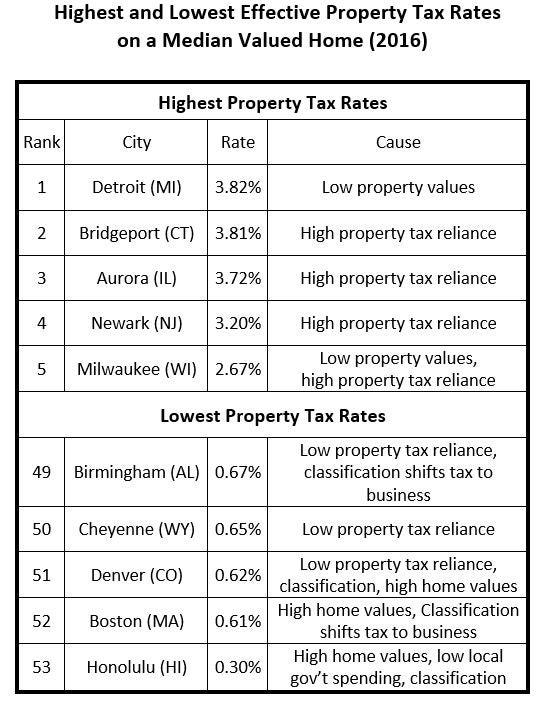

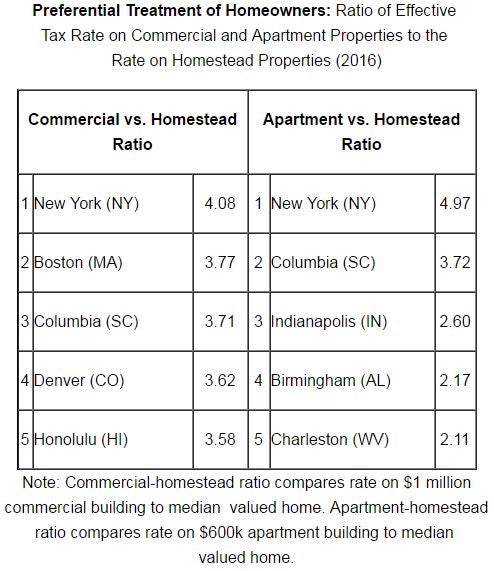

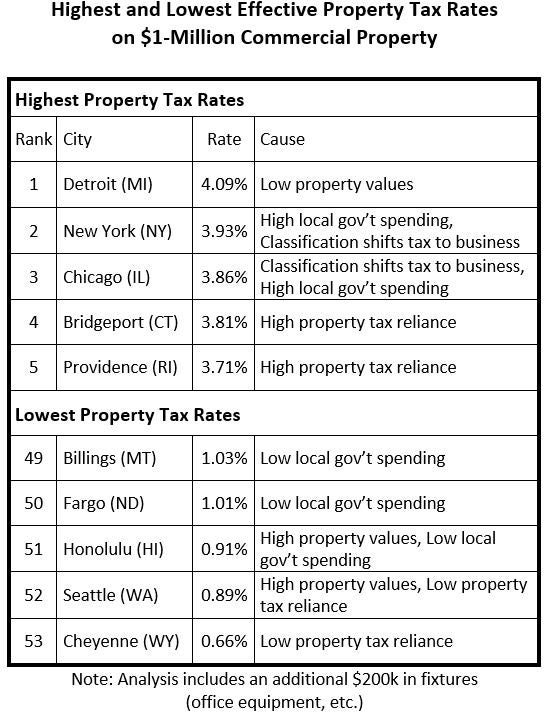

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Understanding California S Property Taxes

South Carolina Income Tax Calculator Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

Florida Sales Tax Rates By City County 2022

County Surcharge On General Excise And Use Tax Department Of Taxation

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

Understanding California S Property Taxes